IX Swap ($IXS): The Uniswap for RWA

Discover how IxSwap is revolutionizing RWA tokenization as the 'Uniswap for security tokens'!

Regulation is certainly one of the biggest challenges of RWA tokenization, especially for security tokens!

IxSwap comes to facilitate safe and convenient issuance, listing, and trading of RWAs, positioning itself as the "Uniswap for RWA".

Curious to learn more? Let’s dive in! 👇

1️⃣ Regulatory Challenges in RWA Tokenization

Transforming physical assets like real estate and commodities into digital tokens is revolutionizing the crypto space. Yet, this innovation isn't without its hurdles.

RWA tokenization must weave through a maze of regulations across various jurisdictions. Compliance with securities laws, AML/KYC requirements, and investor protection measures is crucial.

While these complexities might slow down adoption, they also pave the way for a safer and more transparent market.

There has always been significant debate about whether NFTs are securities.

While NFTs linked to art are like collectibles, attached rights can make them resemble financial products.

2️⃣ What is IxSwap?

IX Swap is a platform that aims to be a one-stop shop for security tokens.

Its goal is to facilitate the issuance, listing, and trading of those assets.

The goal here is to facilitate the trading of digital securities, and become the "Uniswap for RWA".

IX Swap offers a unique interface for both investors and fundraisers called IXS Launchpad. The platform helps fundraisers launch tokens in a fully regulated manner and sell them on a user-friendly platform.

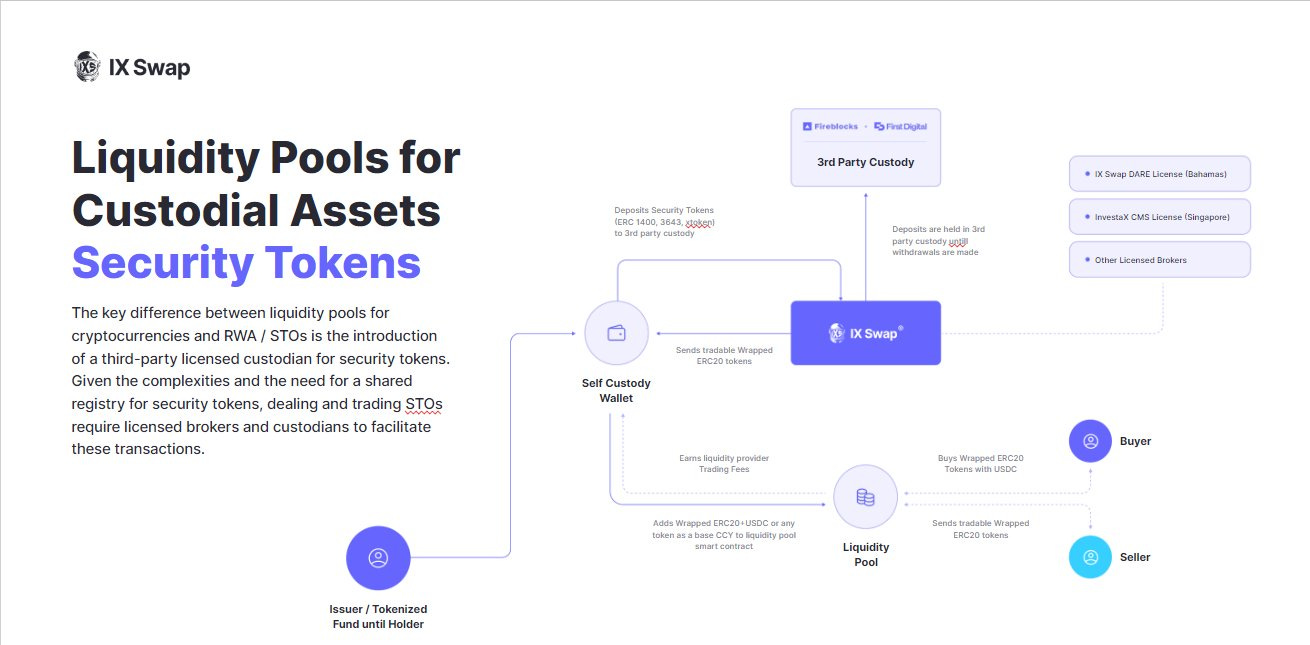

The protocol also offers unique liquidity solutions for security tokens (STOs). LPs for Non-Custodial Assets are just the liquidity pools we know, with the AMM system allowing digital assets to be traded in a permissionless and automatic way.

But when dealing with STOs, the approach must be slightly different. In IX Swap's LPs for Custodial Assets, a third-party licensed custodian is introduced for security tokens due to the complexities and need for a shared registry when handling these assets.

They also introduced a Volatility Mitigation Mechanism. The goal is to reduce long-term risks to people from some dangers, like extreme price changes.

3️⃣ Team

This is the core team of IX Swap:

Julian Kwan - CEO

Aaron Ong - CSO

Alice Chen - General Counsel

Alex Cucer - CTO

Asaf Yosifov - Managing Partner

You can find more about them here

4️⃣ Tokenomics

The $IXS token is the native token of IX Swap and InvestaX CeX.

$IXS also has a deflationary nature, due to its fee structure.

Liquidity providers earn a share of the fees generated by the services on the IX Swap platform.

The remaining portion is allocated to two distinct vaults: the Solar Vault and the Moon Vault.

• Moon Vault utilizes the funds to regularly buy back IXS tokens on the open market.

• In the Solar Vault, the funds deposited are permanently locked or "burned."

You can check out the fee structure below 👇

5️⃣ Metrics

$IXS Funding Rounds:

• Private Rounds: $2.25M raised

• IDO: $286.7K raised

• IEO: $700K raised

$IXS token info:

Current price: $0.2907

Market Cap: $51M

FDV: $52M

Circulating supply: 178.2M

Total Supply: 180M

6️⃣ Final notes

IX Swap transforms every aspect of security tokens, from the listing process to trading. It simplifies the entire experience while addressing regulatory issues.

Before investing in $IXS, ensure you understand all the risks involved.

This thread is intended for educational purposes only and should not be considered financial advice.

Follow us on Twitter for more real-time crypto updates 🐦

Best Regards,

Pedro Veiga - Co-Founder of MOIC Digital