Chainlink Data Streams: The perfect solution for perpetual DEXs

How does Chainlink's Data Streams Benefit Perpetual DEXs and other DeFi apps?

As the DeFi landscape matures, the complexity of its applications also increases. Now, platforms like Perp DEXs critically rely on accessing both timely and accurate market data to deliver an experience on par with CEXs.

Chainlink’s Data Streams serve as an innovation to meet these demands, leveraging a low-latency oracle system that vastly improves the operational efficiency and responsiveness of DeFi applications.

Real-time Data for Perpetual DEXs:

Perpetual DEXs operate similarly to their centralized counterparts but without a central authority, relying instead on smart contracts. These platforms require constant access to accurate price data to function effectively.

Any delay in data can lead to slippage, unfair trade executions, and even arbitrage opportunities that could be exploited.

Chainlink's Data Streams offer a solution through their pull-based model, which fetches data only as needed. This reduces latency significantly compared to traditional push-based models where data is transmitted at regular intervals, regardless of demand.

For perpetual DEXs, this means they can synchronize their trading strategies and risk management systems almost instantaneously with real market conditions, achieving a CEX-like efficiency.

Understanding Pull vs. Push Oracles

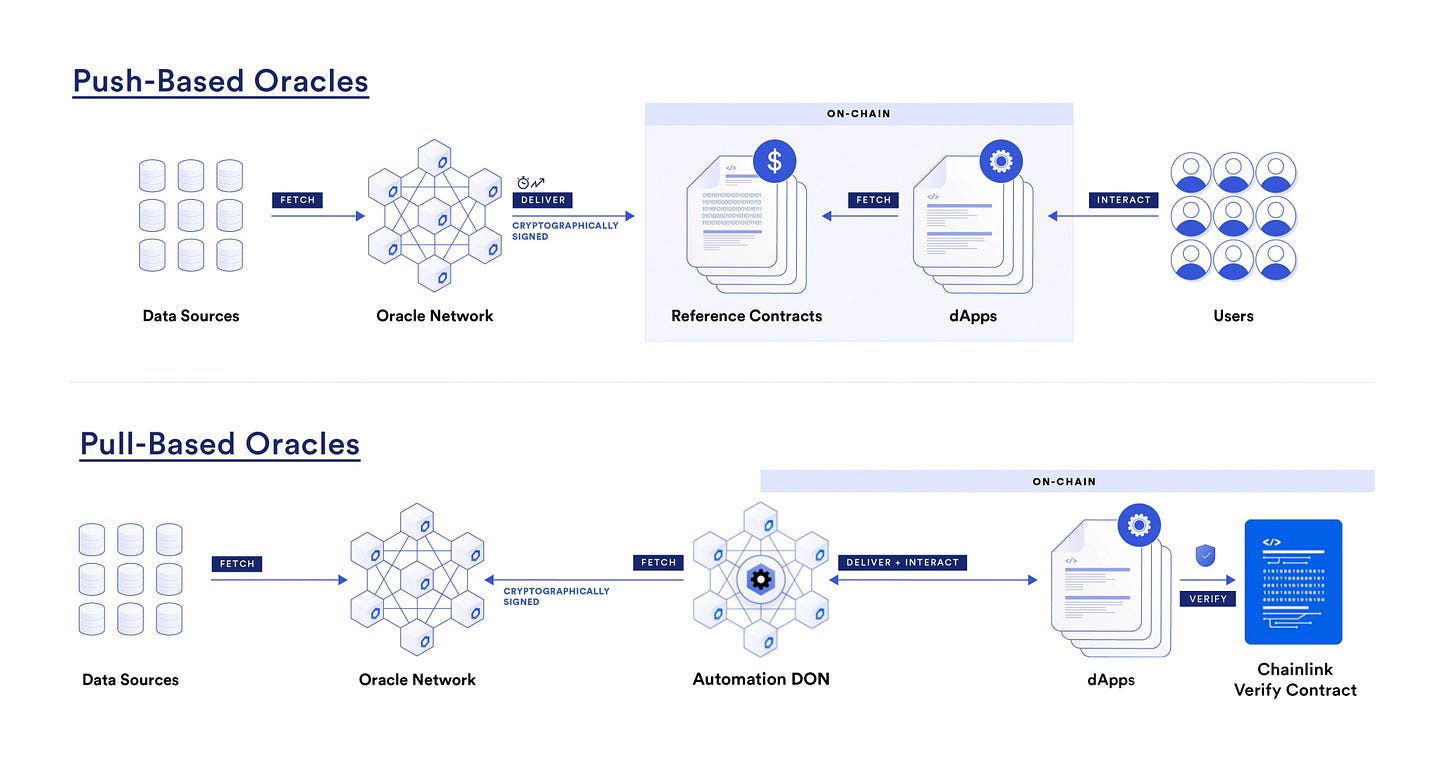

Push-based Oracles:

Push-based oracles are designed to send data to the blockchain at predetermined intervals, regardless of whether the data is immediately needed by the smart contracts.

This approach ensures that blockchain applications have consistent access to updated information. However, it can lead to inefficiencies as data is transmitted and stored on the blockchain even when not in use.

This can increase costs and lead to potential data staleness if the update intervals are not aligned with the needs of the application.

Pull-based Oracles:

In contrast, pull-based oracles operate on a demand-driven model. Data is fetched and sent to the blockchain only when specifically requested by a smart contract.

This method not only helps conserve resources by eliminating unnecessary data transmissions but also ensures that the data is up-to-date at the moment it is needed.

This is crucial for applications where real-time data is vital, such as trading platforms or dynamic pricing models.

Key Advantages of Pull Oracles Over Push Oracles:

• Efficiency and Cost-Effectiveness: Pull oracles transmit data only when necessary, thereby reducing the volume of data transactions and potentially lowering the associated costs.

• Data Freshness and Reduced Latency: By providing data on-demand, pull oracles ensure that the data is the freshest available, crucial for applications requiring real-time information.

• Improved Security and Data Integrity: Pull oracles minimize exposure to security risks by limiting data availability on the blockchain only to moments when it is necessary, reducing the window of opportunity for potential attacks.

While pull oracles offer numerous advantages, they are not universally superior to push oracles. The effectiveness of each type largely depends on the specific requirements and context of the application in question.

Who's Using Data Streams?

The integration of Chainlink Data Streams has been particularly transformative for perp DEXs, where the demand for precise and timely data is paramount.

Platforms like GMX, Zaros, PancakeSwap, Ostium, Perennial, and Ryze have harnessed this technology to create trading environments that rival CEXs in terms of speed, reliability, and user experience, but with the added benefits of decentralization.

In these markets, even milliseconds can impact the outcome, making the low-latency data provided by Chainlink Data Streams critical for maintaining competitive parity with traditional trading platforms.

How Chainlink Data Streams Work: Technical Overview

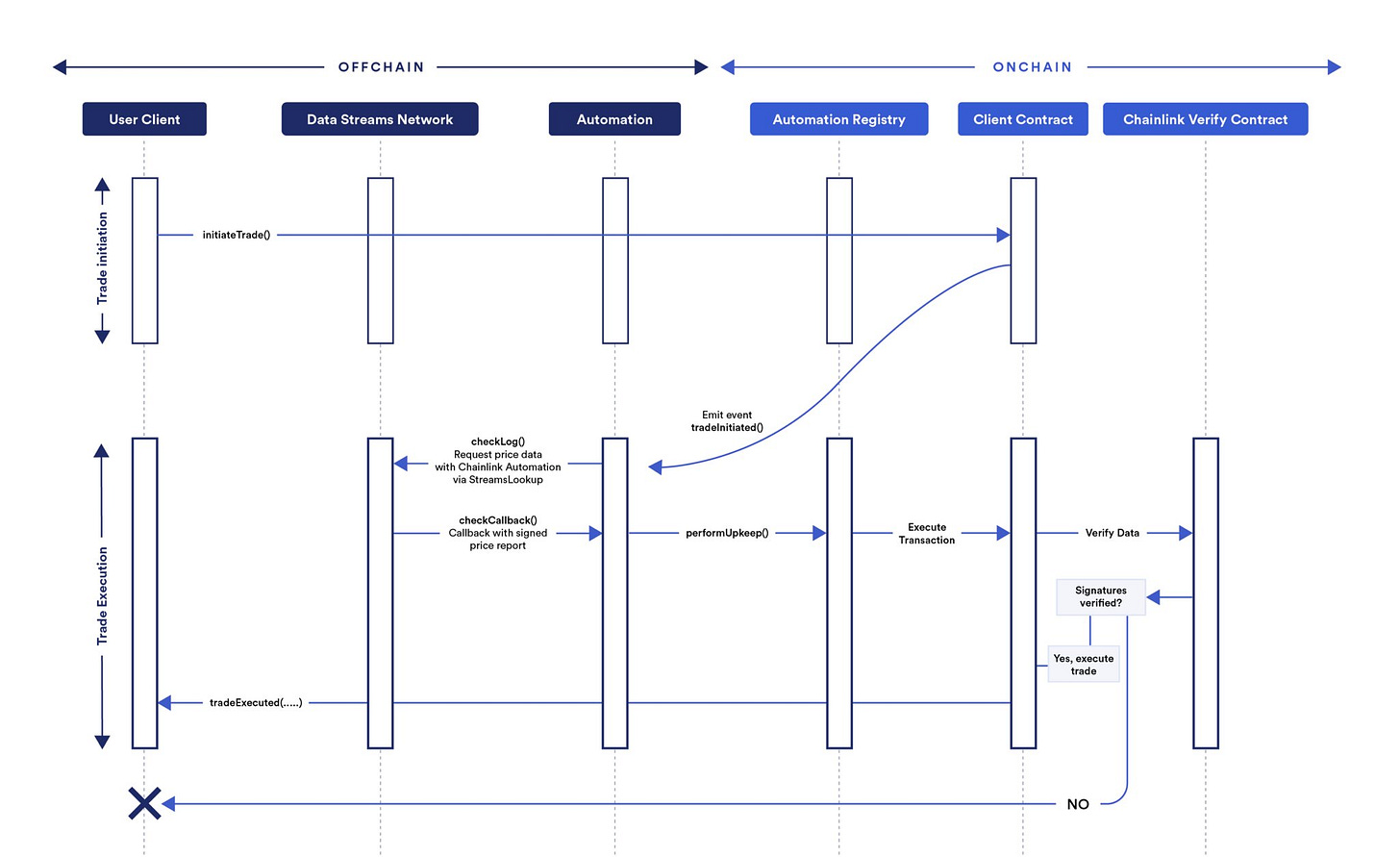

This process involves several technical components and automated execution mechanisms to ensure data integrity and timeliness.

Automated Execution with Chainlink Automation: It operates by continuously monitoring trade submissions on the blockchain. Upon detecting a trade, the system automatically retrieves the necessary price reports from the off-chain data sources. This automation is crucial for maintaining the near-instantaneous data delivery required by high-speed trading applications and DeFi platforms.

Decentralized Oracle Network (DON): This network comprises multiple independent nodes that collaborate to detect trade submissions, retrieve relevant data, and execute trades. By decentralizing these tasks, Chainlink ensures that no single point of failure exists, enhancing the overall security and reliability of the system.

Onchain Validation Contracts: To ensure the integrity and authenticity of the data, Chainlink employs on-chain validation contracts. These contracts cryptographically verify the data received from external sources before it is used in any transaction. This process involves checking the signatures and aggregating data from multiple nodes to reach a consensus, thereby minimizing the risk of data manipulation or inaccuracies.

Data Fetching and Aggregation: Their approach involves pulling data on demand from various trusted sources. These sources include financial markets, exchanges, and other relevant data providers. The data is then aggregated to create a comprehensive report, which is subsequently used by the smart contracts for executing trades or updating positions. This method ensures that the data is both current and reflective of real-time market conditions.

Benefits Across Other DeFi Applications:

Beyond perpetual DEXs, numerous other DeFi applications benefit from Chainlink's low-latency data streams, including:

• Options and Futures Platforms: These platforms can use timely data to accurately calculate the settlement of contracts based on the latest market conditions.

• Lending Platforms: Real-time data ensures that collateralization ratios are adjusted dynamically, reducing the risk of unfair liquidations or insolvencies due to outdated information.

• Prediction Markets: Faster data updates enable more responsive markets where users can bet on outcomes based on the latest information, increasing the markets' attractiveness and fairness.

Future Prospects and Impact on DeFi As more DeFi platforms such as

GMX and Zaros adopt Chainlink Data Streams, and the potential for increased market efficiency and liquidity becomes more pronounced.

This technology not only drives the growth of individual platforms but also contributes to the health of the broader blockchain ecosystem by ensuring that data remains a secure foundation for dApps.

In conclusion, Chainlink Data Streams are setting a new standard for data utility in blockchain environments, crucially supporting the intricate needs of modern financial applications.

This not only enhances the operational capabilities of DeFi platforms but also aligns with the broader blockchain community's goals of creating open, transparent, and efficient financial systems.

That wraps up our discussion for today, folks!

Follow us on Twitter for more real-time crypto updates 🐦

Best Regards,

Pedro Veiga - Co-Founder of MOIC Digital